Know Your Tax Refund Before You Agree to Anything

-

Average Refunds of £2,550

-

Use Our Simple and Easy Process

-

Trust Experts With Decades of Experience

-

No Refund, No Fee, So We Only Get Paid If You Do

-

Benefit from our 100% Guarantee Against any HMRC Enquiry

HMRC Hold Onto Over £400 million In Unclaimed Tax Each Year

—

Are You Included?

Simple & Easy Process

There is no need to fill out endless forms or stay on the phone for hours. Let us do the work while you relax.

Best Refunds

Maximoor knows exactly how to maximise your tax refund, whilst keeping you safe from HMRC. Our average repayment is £2,550.

Decades of Experience

Maximoor has submitted 1000s of Tax Returns. Our Directors have decades of experience in law, accountancy and taxation.

HMRC Hold Onto Over £400 million In Unclaimed Tax Each Year

—

Are You Included?

Simple & Easy Process

There is no need to fill out endless forms or stay on the phone for hours. Let us do the work while you relax.

Best Refunds

Maximoor knows exactly how to maximise your tax refund, whilst keeping you safe from HMRC. Our average repayment is £2,550.

Decades of Experience

Maximoor has submitted 1000s of Tax Returns. Our Directors have decades of experience in law, accountancy and taxation.

Why Maximoor?

Maximoor Guarantee

We Are Confident In Our Work, So We Provide Guarantees

1. No Refund, No Fee

If we submit a tax refund claim to HMRC and it is unsuccessful, we will not charge you a fee. That way, we only get paid if you do.

2. HMRC Enquiry Protection

If HMRC launch an enquiry into any of the returns that we submit, we will deal with the enquiry free of charge.

See Terms and Conditions

Maximoor Guarantee

We Are Confident In Our Work, So We Provide Guarantees

1. No Refund, No Fee

If we submit a tax refund claim to HMRC and it is unsuccessful, we will not charge you a fee. That way, we only get paid if you do.

2. HMRC Enquiry Protection

If HMRC launch an enquiry into any of the returns that we submit, we will deal with the enquiry free of charge.

See Terms and Conditions

The Process

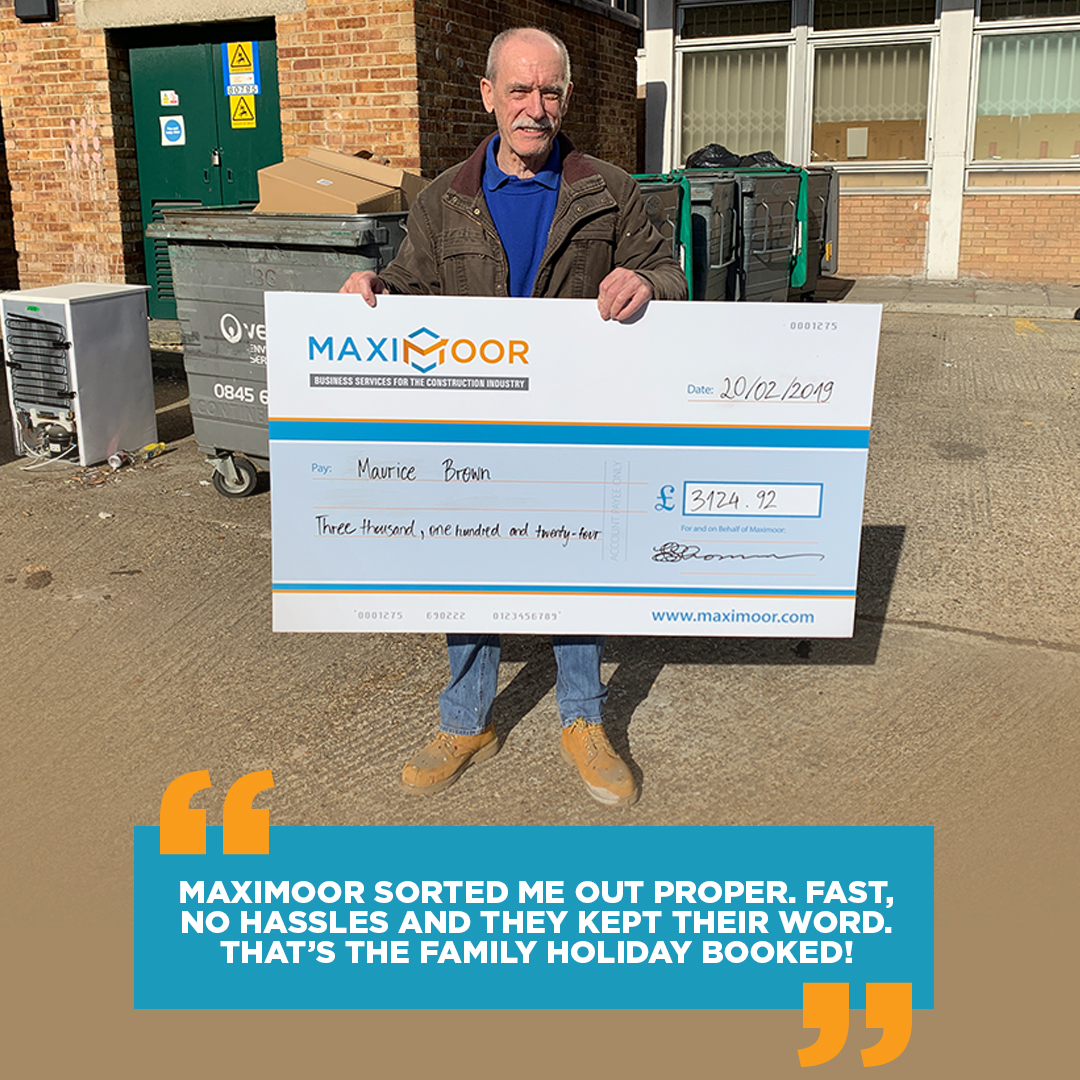

Hear What Our Clients Have To Say

Meet Alan

Alan has been a client of ours for over 5 years. In total we have successfully claimed £18,397.15 in tax refunds from HMRC for Alan.

Before he found us, Alan was having a hard time, dealing with long delays and low refunds. With our simple & easy process and experience within the industry, he has finally found a company to trust.

Alan answered a few questions for us about his experience with our service. Check out the video.

"From start to finish it has been no stress, everything made easy for me. Made my whole year."

"I thought that it was going to be alot of effort and time consuming but this was mitigated by the professionalism I received."

"Maximoor customer service is amazing, they are helpful and I am happy with the team."

Refer A Friend, Get £50 Cash

Frequently Asked Questions

It depends. Once we receive all of your paperwork we aim to take under a week to prepare your Claim. Once you claim is submitted to HMRC, it is in their hands. We estimate between 2 and 4 weeks until the money is in your bank account.

Of Course!

Unlike other companies, we don’t lock you into an obligation. You only need to agree to moving forward once you’ve seen your tax return and approved it for submission.

Our Average CIS Claim is over £2,550.

We can claim for a variety of expenses. These are purchases made for the purpose of your work. These may include:

-

Travel Costs

-

Tools

-

Subscriptions

-

Uniform

-

PPE

-

Mobile Phone Costs

-

And More...

Other than CIS Tax Refunds, we offer the following:

PAYE Tax Refunds

Limited Company Formation

Payroll

IR35 Reviews

Accountancy and Bookkeeping