Providing Business Services to the Construction Industry

Maximoor is an expert in accounting, tax and business. We handle the confusing paperwork, so you can do the real work.

How Can We Help?

CIS Tax Refunds

Many companies offer a service to claim your CIS Tax Refund, but not many companies know how to do it properly. Get your rebate quickly and easily, with a professional service, ran by experienced and qualified experts. Maximise your refund, whilst staying safe from HMRC.

PAYE Tax Refunds

It's a common misconception that getting tax refunds for employed workers is impossible. The truth is that expertise and experience is required to maximise the claim, whilst keeping the taxpayer safe from any HMRC enquiry.

Limited Companies

Operating under a limited company comes with a variety of opportunities to maximise your income, but the rules are complicated and require precise actions to ensure that you meet the obligations that are required of you.

Payroll

The Paye-As-You-Earn system, turns employers into tax collectors. Now, not only do you need to work out your own taxes but also that of your employees. We like to take a transparent, helpful and effiecent approach to let you focus on what makes you money.

IR35 Reviews

As either a worker operating via an intermediary or a contractor hiring workers through an intermediary, you may wish to protect yourself from the potentially expensive HMRC enquiry process by conducting a professional IR35 contract review.

Accountancy

Sometimes managing your business can feel like managing a whole new employee. Let Maximoor handle the paperwork and make your business start working for you. Accounts, Companies House Filings, VAT, Bookkeeping and Payroll are all things that can be taken off of your desk.

How Can We Help?

CIS Tax Refunds

Many companies offer a service to claim your CIS Tax Refund, but not many companies know how to do it properly. Get your rebate quickly and easily, with a professional service, ran by experienced and qualified experts. Maximise your refund, whilst staying safe from HMRC.

PAYE Tax Refunds

It's a common misconception that getting tax refunds for employed workers is impossible. The truth is that expertise and experience is required to maximise the claim, whilst keeping the taxpayer safe from any HMRC enquiry.

Limited Companies

Operating under a limited company comes with a variety of opportunities to maximise your income, but the rules are complicated and require precise actions to ensure that you meet the obligations that are required of you.

Payroll

The Paye-As-You-Earn system, turns employers into tax collectors. Now, not only do you need to work out your own taxes but also that of your employees. We like to take a transparent, helpful and effiecent approach to let you focus on what makes you money.

IR35 Reviews

As either a worker operating via an intermediary or a contractor hiring workers through an intermediary, you may wish to protect yourself from the potentially expensive HMRC enquiry process by conducting a professional IR35 contract review.

Accountancy

Sometimes managing your business can feel like managing a whole new employee. Let Maximoor handle the paperwork and make your business start working for you. Accounts, Companies House Filings, VAT, Bookkeeping and Payroll are all things that can be taken off of your desk.

Need to Speak On The Phone? Call Us on 020 3011 1335

Over £5,000,000 In Tax Claimed Back For Clients In The Last 3 Years Alone

Over 100 Appeals Won Against HMRC

25 Years Of Combined Experience Negotiating With HMRC

Trained Over 10 Accountants

Maximoor is a family company that offers professional business services to small and medium sized enterprises in the construction industry. In 2020 we completed the first rollout of the company’s services, which concentrated on securing taxation refunds for subcontractors operating under the construction industry scheme. The company continues to enjoy a great deal of success in the area and this service will remain a fundamental aspect of our business. We are currently in the second phase of the company’s development, which concentrates on providing taxation, payroll, accountancy and corporate services to small and medium sized construction companies. The coronavirus pandemic delayed this launch somewhat, but it is now in fullflow. It provides a balance for our clients and ensures they can outsource (should they wish to do so) their entire accounts and payroll departments. The third and final phase of the company rollout, which will commence next year, will be development of our position as the principal multidisciplinary professional services company in the UK for the construction industry, incorporating taxation, payroll, accounting, recruitment, legal and financial services.

Our Partners

Our Partners

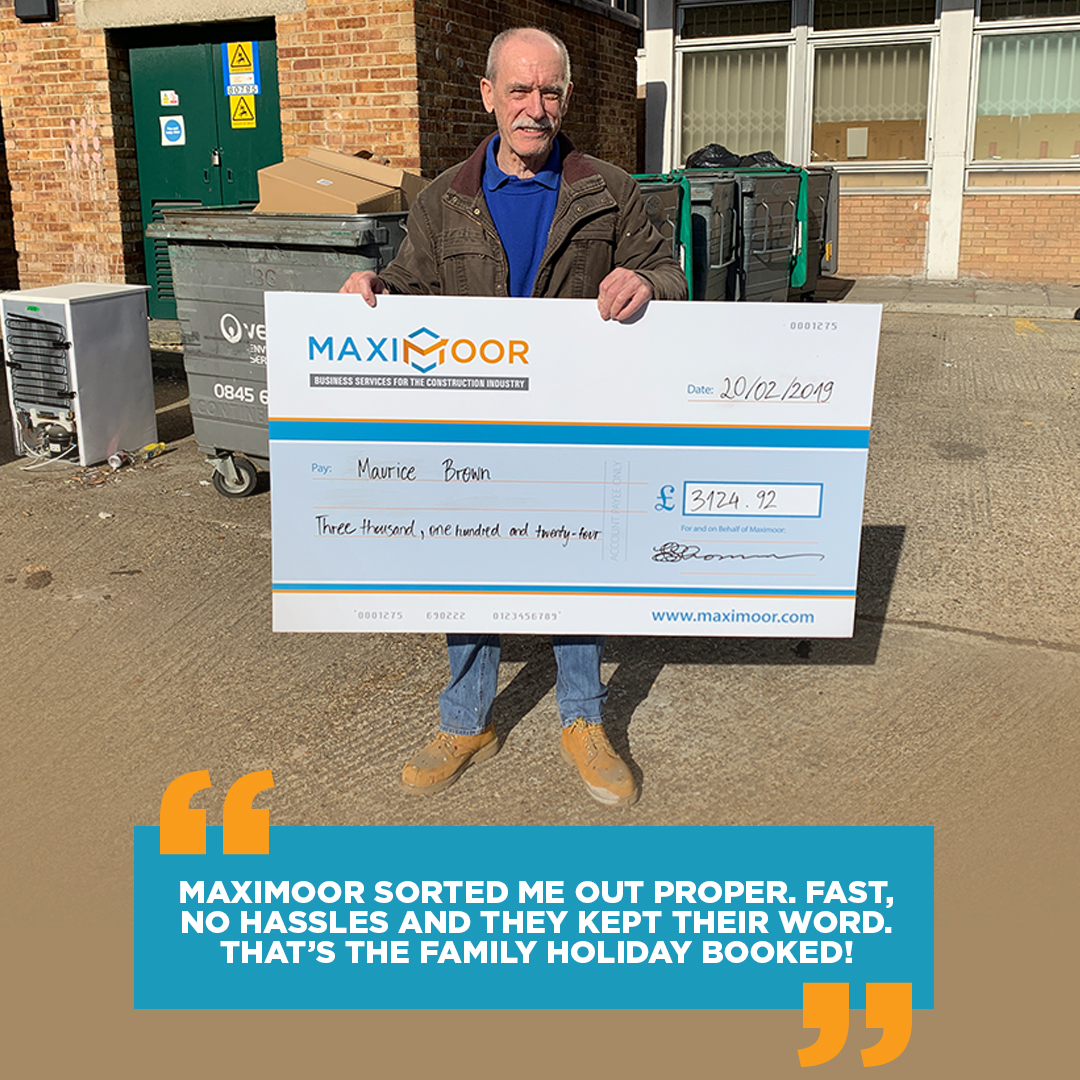

Hear What Our Clients Have To Say

Meet Alan

Alan has been a client of ours for over 5 years. In total we have successfully claimed £18,397.15 in tax refunds from HMRC for Alan.

Before he found us, Alan was having a hard time, dealing with long delays and low refunds. With our simple & easy process and experience within the industry, he has finally found a company to trust.

Alan answered a few questions for us about his experience with our service. Check out the video.

"From start to finish it has been no stress, everything made easy for me. Made my whole year."

"I thought that it was going to be alot of effort and time consuming but this was mitigated by the professionalism I received."

"Maximoor customer service is amazing, they are helpful and I am happy with the team."