Take Control Of Your Business

-

Get Higher Tax Repayments

-

Use Our Simple and Easy Process

-

Benefit From Limited Liability

-

Add New Legitimacy To Your Business

-

Benefit from our 100% Guarantee

Limited Liability

Operating via a limited company gives you the benefit of limited liability. This means that your personal assets are protected from any business losses, court cases or even HMRC penalties.

Control

Owning your own business gives you a new sense of control and responsibility. For the right person, this is the perfect motivation to take your finances to new heights.

Professionalism

Give your trade a professional feel. Every Maximoor limited company comes with a free professional email address to give you added presence and creditability.

Earn More With Maximoor

Operating under a limited company comes with a variety of opportunities to maximise your repayment, but the rules are complicated and require precise actions to ensure that you meet the obligations that are required of you.

Having an expert partner like Maximoor on your side is crucial in making sure you take all of the advantages available and do so in the right way.

Trust An Expert

Streamlined Process

We take pride in operating a streamlined, efficient process. We regularly seek to refine our systems to ensure that we are offering the best service possible.

It’s this process which enables us to offer such low prices with such unique features.

Well-Trained Staff

We believe in a constant approach to improvement and this is reflected in the knowledge and commitment of our staff. Any client of ours can expect to deal with staff who are up to date with the latest tax saving changes.

Experience

Having been providing business services to the construction industry for many years, we have been able to develop a unique level of experience in this area. This allows us to offer our clients a tailored service which suits our client’s needs.

Get A Company Bank Account In Minutes

Due to our partnership with Tide, we can get you a company bank account in a matter of minutes.

This eliminates a lot of the hassle usually associated with incorporating a limited company and switching over from a personal to a business bank account.

Tide offers brilliant modern features:

-

Invoicing and Invoice Protection

-

Auto-Categorisation

-

Receipt Matching

-

24/7 Support Via Their App

All with no monthly fee.

By coming through us, you will benefit from no transfer fees on the account from the whole year!

Our Plans

Subcontractor

£99 + VAT Per Month

+ 10% of Your Repayment

-

Full Company Incorporation

-

Registered Office Service

-

Post Scanning

-

Company Email Address

-

Bank Account Setup

-

PAYE Registration

-

CIS Registration

-

Invoice Preparation

-

Year-End Financial Statements

-

Year-End Corporation Tax Returns

-

Self-Assessment Tax Return

For 1 Director -

Full Year-Round HMRC Support

-

Monthly Payroll Submissions For 2 Employees

-

Unlimited Email and Phone Support

-

Repayment Claim Maximisation

General Trader

£149 + VAT Per Month

-

Full Company Incorporation

-

Registered Office Service

-

Post Scanning

-

Company Email Address

-

Bank Account Setup

-

PAYE Registration

-

CIS Registration

-

Invoice Preparation

-

Year-End Financial Statements

-

Year-End Corporation Tax Returns

-

Self-Assessment Tax Return For 2 Directors

-

Full Year-Round HMRC Support

-

Monthly Payroll Submissions For 3 Employees/Subcontractors

-

Unlimited Email and Phone Support

-

Repayment Claim Maximisation

-

Free Single IR35 Review Worth £199

-

Pension Scheme Support

-

CIS Gross Payment Status Claim

Contractor

£249 + VAT Per Month

-

Full Company Incorporation

-

Registered Office Service

-

Post Scanning

-

Company Email Address

-

Bank Account Setup

-

PAYE Registration

-

CIS Registration

-

Invoice Preparation

-

Year-End Financial Statements

-

Year-End Corporation Tax Returns

-

Self-Assessment Tax Return For 3 Directors

-

Full Year-Round HMRC Support

-

Monthly Payroll Submissions For 10 Employees/Subcontractors

-

Unlimited Email and Phone Support

-

Repayment Claim Maximisation

-

Free Multi IR35 Review Worth £399

-

Pension Scheme Support

-

CIS Gross Payment Status Claim

-

Annual In-Person Meeting

-

VAT Registration

-

Quarterly VAT Returns

-

Business Plan Support

-

Employment Law Support

Our Plans

What Plan Is Right For Me?

We offer 3 different plans. Each plan is tailored for a different type of business, with different features and costs.

Subcontractor Plan

Our Subcontractor plan is tailored towards people just starting out on their own, whose income is subject to CIS Deductions. We will get you sorted with a modern business bank account, and make sure you are fully supported on your journey towards business success.

This plan costs £99 + VAT per month, with a 10% fee deducted from your repayment.

General Trader Plan

Our General Trader plan is tailored towards small businesses, with or without employees or subcontractors. These businesses may subcontract from larger contractors or do jobs with private individuals. We will assess your risk to IR35 and ensure you are fully compliant with all the new rules. We will get you sorted with a modern business bank account, and make sure you are fully supported on your journey towards business success.

This plan costs £149 + VAT per month, with no fees deducted from any tax repayment.

Contractor Plan

Our Contractor plan is tailored towards small to medium sized businesses. We will support your growth with business plan support, ensure your compliance with complicated VAT rules (including the new VAT Construction Reverse Charge). We will provide you with need to know information on employment law. We will also seek to improve your cashflow by aiding you in a CIS Gross Payment Status request.

This plan costs £249 + VAT per month, with no fees deducted from any tax repayment.

Get Paid Without CIS Deductions

Once, your limited company has been set up for a year and you have shown the reliability to behave honestly and comply with all of the rules and regulations laid out by HMRC, you will be able to request to HMRC that you be paid gross from contractors, without any CIS Deductions. This is known as Gross Payment Status.

This will massively improve cashflow for your business and prevent having to wait to the end of the tax year to make a claim for repayment if you have over paid.

HMRC retain over £400 million in unclaimed CIS Deductions each year, so obtaining this status is not easy. There are three tests: the business test, the turnover test and the compliance test. Each of which the business needs to meet. As part of our General Trader and Contractor plans, we will assist you in these applications.

Each year, HMRC undertakes a review of Gross Payment Status businesses, and they have the ability to take away your Gross Payment Status. We will communicate with HMRC throughout these reviews to ensure that the process is fair and just.

Maximoor Guarantee

We Are Confident In Our Work, So We Provide Guarantees

HMRC Enquiry Protection

If HMRC launch an enquiry into any of the returns that we submit, we will deal with the enquiry free of charge.

This gives you complete peace of mind that your refund is yours to keep.

See Terms and Conditions

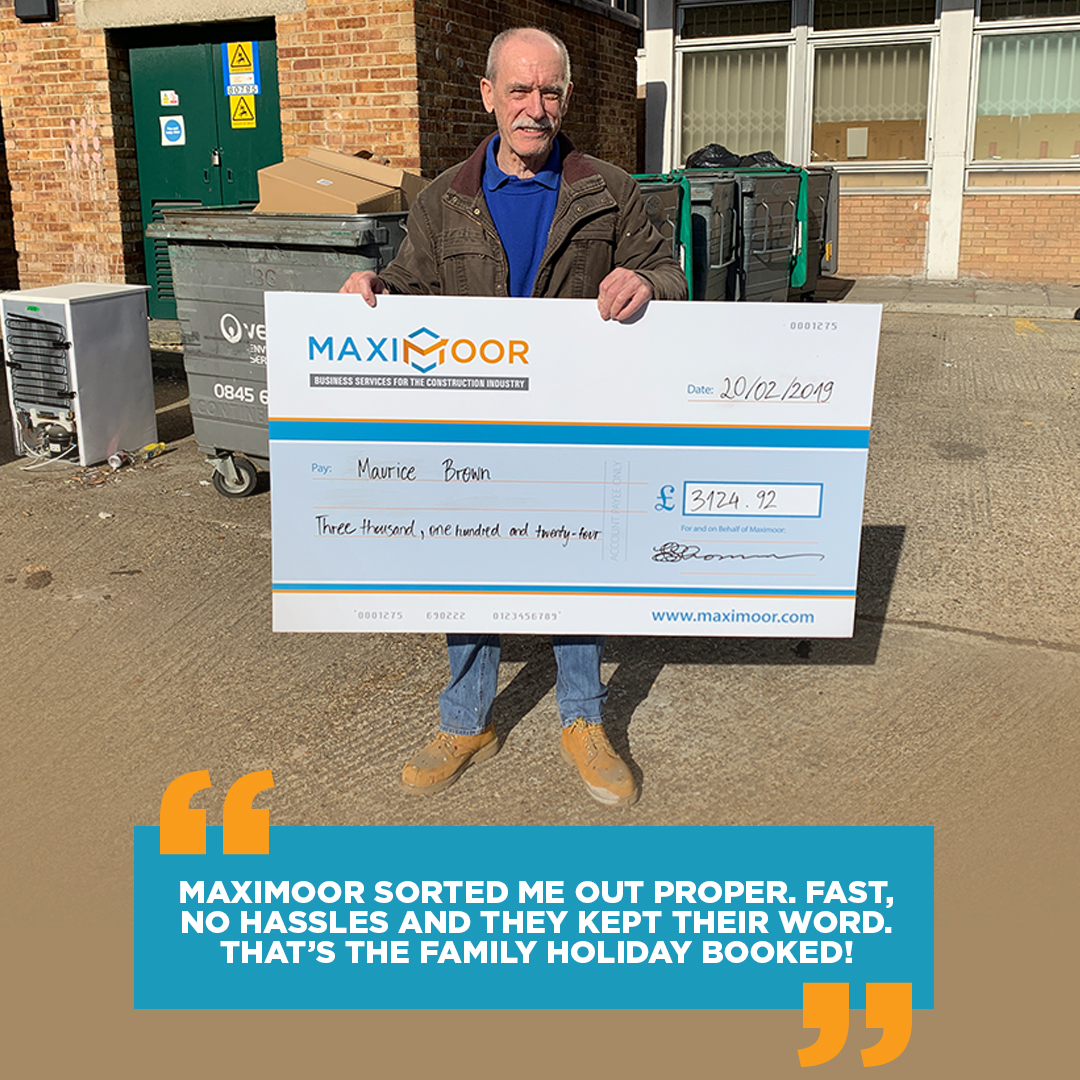

Hear What Our Clients Have To Say

Meet Alan

Alan has been a client of ours for over 5 years. In total we have successfully claimed £18,397.15 in tax refunds from HMRC for Alan.

Before he found us, Alan was having a hard time, dealing with long delays and low refunds. With our simple & easy process and experience within the industry, he has finally found a company to trust.

Alan answered a few questions for us about his experience with our service. Check out the video.

"From start to finish it has been no stress, everything made easy for me. Made my whole year."

"I thought that it was going to be alot of effort and time consuming but this was mitigated by the professionalism I received."

"Maximoor customer service is amazing, they are helpful and I am happy with the team."

Refer A Friend, Get £100 Cash

Frequently Asked Questions

The incorporation and registration process takes roughly 3 weeks. Then, your company is up and running, ready for you use. After that, to maintain your company properly, each month we must make submissions to HMRC and each year we must make submissions to Companies House.

In order to properly look after your limited company, we will need some information from you during the initial setup period. We minimise your involvement by using our streamlined process, with clear guides and well-trained staff.

Not At All!

Our service operates on a 12 month basis. This means that if you would like to close your limited company for any reason, you can do so, just with some notice.

Absolutely!

We have helped many clients whose previous accountants did not manage their limited companies correctly. We will endeavour to correct any issues and get you onto the right monthly plan.

With our Maximoor Guarantee, your Tax Refund is protected! There’s no need to worry about HMRC coming back to take your refund away years down the line. We will deal with everything for you.

Check our Terms and Conditions for full details.

For Limited Companies, we estimate our repayments to be over £3,000.

We can claim for a variety of expenses. These are purchases made for the purpose of your work. These may include:

-

Travel Costs

-

Tools

-

Subscriptions

-

Uniform

-

PPE

-

Mobile Phone Costs

-

And More...

Maximoor is a registered and authorised HMRC Agent. We are also regulated by HMRC under Anti-Money Laundering Regulations.

Our full company name is Maximoor CIS Limited (CRN: 11492815) and we are registered for VAT (VAT Number: 380350416).

Other than Limited Company Formation and Maintenance, we offer the following:

CIS Tax Refunds

PAYE Tax Refunds

Payroll

IR35 Reviews

Accountancy and Bookkeeping